Portfolio Setup & Results Spreadsheets

2 spreadsheets in 1 master spreadsheet

NOTE: This product is included in all 3 CEO Packages.

Portfolio Setup Spreadsheet

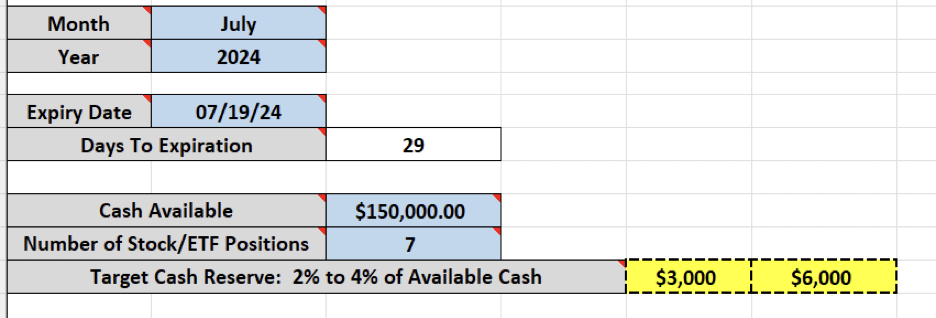

Top section

- Enter contract month, year and expiration date

- Enter cash available and # securities to be included in the

portfolio - Spreadsheet calculates the # of days to expiration

- Spreadsheet calculates a target cash reserve for potential

exit strategy executions - Includes an instruction section

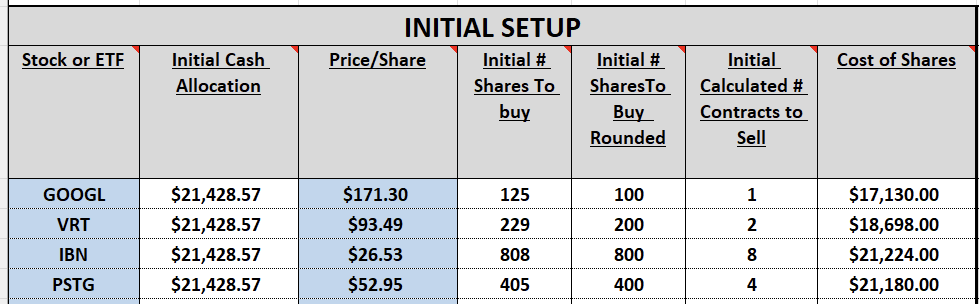

Bottom left section: Initial Setup

- Enter the stock or ETF symbol into the blue cells

- The spreadsheet calculates a cash allocation per position stat

- The spreadsheet calculates the # of shares that can be purchased based on cash allocation and rounds that figure up or down

- Based on the rounding figure, the spreadsheet shows the # of contracts that can be sold

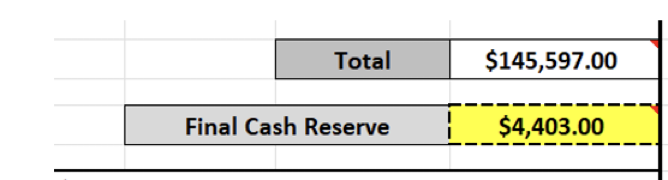

- Scrolling to the bottom left, we see the total cost of the shares and cash reserve (if any)

- If the initial setup does not align with our investment cash available and/or the cash reserve guidelines, we move to the bottom right section

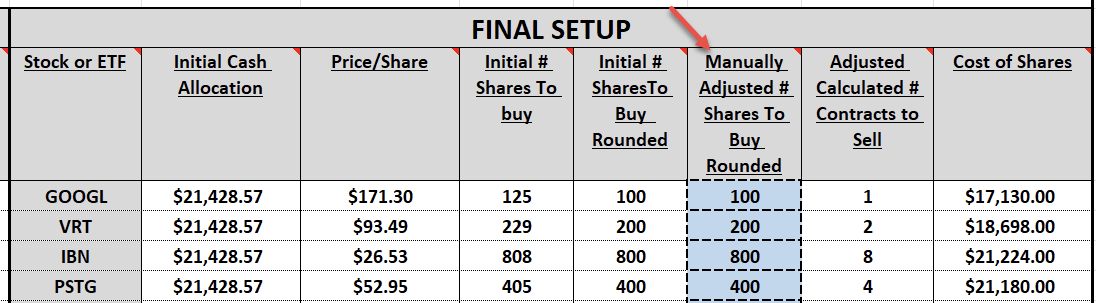

Bottom right section: Final Setup

- If needed, allows the user to manually adjust the # of shares

purchased to align with the cash available and cash reserve

guidelines - Scrolling to the bottom right, we see the adjusted total to be

spent and the updated cash reserve

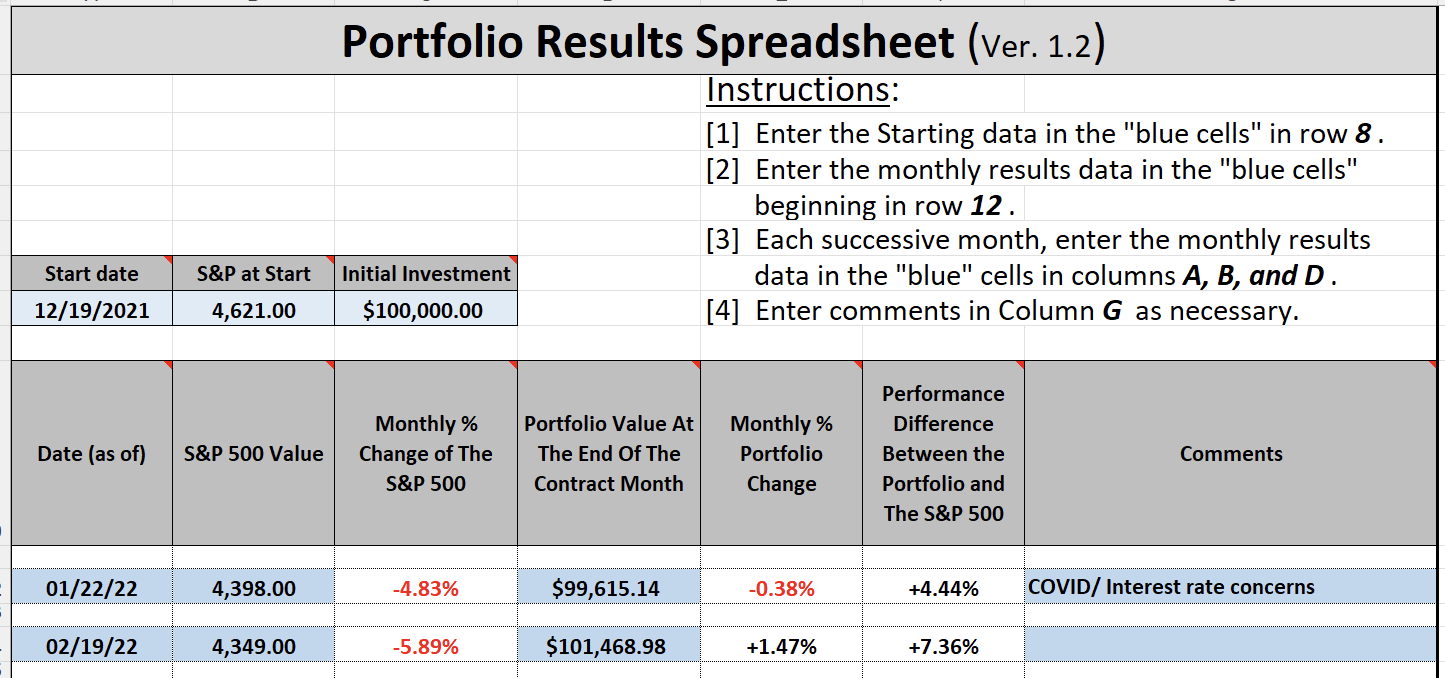

Portfolio Results Spreadsheet

Top section

- Enter start date, S&P at start and initial cash investment

- Includes an instruction section

Bottom section

- Enter into blue cells the results date, value of the S&P 500 and value of the portfolio

- Spreadsheet calculates the monthly % change in the S&P 500

- Spreadsheet calculates the monthly % change in the user’s portfolio

- Spreadsheet calculates the performance difference between the user’s portfolio and the S&P 500

- Comments section

How to Access Each Spreadsheet

- Scroll to the bottom of the master spreadsheet

- Click on the tab of the desired spreadsheet

NOTE: This product is included in all 3 CEO Packages.